Jun. 8, 2023 "Don’t ask us to come into the office more — or we'll quit, investors say": Today I found this article by Jo Constantz and Sarah Holder on the Financial Post:

Financial professionals have a warning for their employers: Don’t ask me to come in to the office more often, or I’ll quit.

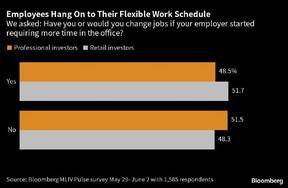

That’s according to the latest Markets Live Pulse survey, which found that roughly one in two people who work in finance would change jobs — or already have — if their managers required them to spend more time in the office.

More than half of the 1,585 respondents globally, which included

1,320 financial professionals

and 265 retail investors,

prefer a hybrid arrangement,

while only about 20 per cent favour working from the office.

The number of people responding to the survey was well above the average participants in recent MLIV Pulse surveys in a sign that return to the office is still top of mind for many professionals.

Of course,

pledging to quit over hybrid work is easier said under the veil of anonymity than

followed through with actions.

Wall Street chiefs have been among the loudest in pushing for a return to the office five days a week.

JPMorgan Chase & Co. ended remote arrangements for its managing directors in April, saying they now must be in the office every weekday.

The policy comes on the heels of comments from the bank’s chief executive Jamie Dimon earlier this year that working from home “doesn’t work” for younger staff or bosses.

About 40 per cent of financial professionals say they already work from the office four days a week or more, according to the MLIV Pulse survey — roughly double the number that said they prefer working from the office.

Though the financial sector hasn’t seen layoffs at the same scale as tech or retail,

a report from Challenger, Gray & Christmas Inc., an executive coaching firm,

shows that the industry has cut nearly 37,000 jobs in the United States so far this year,

a figure up 320 per cent from the same period last year.

Goldman Sachs Group Inc. is working on what would be the third round of layoffs in less than a year as deal-making remains sluggish.

Morgan Stanley has embarked on its second round of cuts in less than six months.

Despite these high-profile layoffs, Andy Challenger, senior vice president at Challenger, says the picture for job-hunting banking professionals isn’t as dire as it might seem.

U.S. employers added some 339,000 jobs in May,

a payroll boom that far outstripped expectations

and reinforced the perception that workers’ economic position remains relatively strong.

“When we look at the overall labour market, and we look at finance, unemployment remains really low, historically low,” Challenger said.

“There still are job opportunities available and companies are still hiring.

So it’s not an awful job market to go out and look in.”

According to the MLIV Pulse poll, layoffs haven’t influenced how often people have come into the office.

Only about one in 10 Wall Street professionals said the recent downsizing has motivated them to badge in more frequently.

What would be more difficult would be to find another job in the sector that has a more flexible schedule, Challenger said, as many of the big financial firms change work-from-home policies in lockstep.

Still, more than two-thirds of banks offer either full flexibility or a structured hybrid arrangement,

according to a survey by Scoop Technologies Inc., a firm that helps companies co-ordinate hybrid teams.

Moving from requiring two days in the office to three may give rise to some grumbling but likely wouldn’t be a “walk-away point,” said Rob Sadow, co-founder and CEO of Scoop. But when trying to cross the four-day threshold, employers may start to see the dynamic change.

“Four days a week or more, a lot of people will pick their head up and at least look around and see what their options are,” even if a rocky macroeconomic environment ultimately steers them to stay put, he said.

“Employees are really nervous to give even a fingernail on flexibility. Because they think if they give an inch, the employer might keep pulling,” Sadow said of the number of survey respondents who said they’d quit if asked to come in more.

“So you might see really strong rhetoric or response on flexibility because they think it’s not just that they’re going to be asked to come in a day more — it feels like a gateway to being asked to come in full time.”

For now, the most powerful determinant of how much time people spend in the office appears to be company policies:

About 86 per cent of financial professionals are complying with their company’s in-office mandates.

Those that aren’t meeting the requirements say that most of the time, they’ve faced no consequences.

Of the 1,320 financial professionals surveyed, only 28 said they’ve been reprimanded by their manager or HR for failing to comply.

Five respondents said they’d faced compensation-related penalties

and two said they’d faced termination.

City leaders have been among the most outspoken in calling workers back to the office, concerned about the impact remote work has had on their downtowns.

New York City, for example, is losing more than US$12 billion a year

as workers spend 30 per cent fewer days in the office

and therefore give less business to Manhattan vendors during the week, according to a Bloomberg News analysis.

New York, along with Chicago, San Francisco and Philadelphia, are still seeing a deep decline in weekday lunch traffic compared to before the pandemic,

according to the restaurant management software provider Toast — a trend attributable both

to hybrid work

and to inflation bringing up the cost of eating out.

MLIV Pulse survey showed that even financial professionals, who typically have more disposable income than the average city resident, are reining in their weekday spending:

While half reported that their dining habits post-pandemic haven’t changed at all,

about a third are packing their lunch,

eating office food

or going straight home without grabbing after-work drinks more often than they used to.

MLIV Pulse is a weekly survey of Bloomberg News readers on the terminal and online, conducted by Bloomberg’s Markets Live team, which also runs a 24/7 MLIV Blog on the terminal.

The survey about return to office, conducted May 29- June 2, drew responses from

portfolio managers,

researchers,

strategists,

economists,

traders,

investment bankers,

as well as retail investors.

https://financialpost.com/fp-work/dont-ask-come-to-office-more-well-quit-investors

Seems that as compensation and bonuses are negotiated in the future we may see some cost savings for companies who allow workers to stay at home.

Possibly even impacting decisions of the amount performance bonuses.

That way workers will be able to make choices knowing the financial impact of their decisions.

Turning these empty office towers into immigrant housing is the only real answer.

Unless they own the building I do not know why more companies do not move out of the downtown.

It is a good argument that reduces the hours in Toronto grid lock, doesn't have to step over the homeless, get knifed on the subway , afford a bigger house or apartment and not pay a fortune for parking.

Interesting if the question was asked: if they lived say ten minutes from home would work from home in a smaller urban area not be as attractive?

Feb. 13, 2024 "Ordering workers back to the office a 'power grab' by bosses, research suggests": Today I found this article by Victoria Wells on the Financial Post:

Remote workers who’ve been ordered back to the office might suspect the directive is nothing more than a power trip by the boss, and research suggests they’re probably right.

Return-to-office (RTO) mandates are often

a control tactic by managers

and don’t boost company performance,

according to a new research paper from the Katz Graduate School of Business at the University of Pittsburgh.

What’s more, the mandates appear to make employees less happy with their jobs.

Researchers at the university examined how RTO mandates at 137 S&P 500 companies affected profitability, stock returns and employee job satisfaction.

They discovered that companies with poor stock market performance were more likely to implement RTO policies.

Managers at such companies were also likely to point the finger at employees for the company’s poor financial showing, seeing it as evidence that working from home lowers productivity.

Companies pushing for more days in the office tended to be led by “male and powerful CEOs,” the researchers said,

underlining a belief among workers that mandates were being used by leaders to reassert control.

“Our findings are consistent with employees’ concerns that managers use RTO for power grabbing and blaming employees for poor performance,” the authors said in their paper.

“Also, our findings do not support the argument that managers impose mandates because they believe RTO increases firm values.”

Indeed, requiring more days in the office did nothing to

improve profitability

or boost stock prices,

the researchers said. But it did seem to

make employees miserable,

and more likely to complain about the daily commute,

loss of flexibility

and erosion in work-life balance,

according to reviews on Glassdoor.

It also made them less trusting of their managers. “We find significant declines in employees’ overall ratings of

overall job satisfaction,

work-life balance,

senior management

and corporate culture after a firm announced an RTO mandate,”

the researchers said.

Returning to the office remains a contentious subject between employers and employees, and many companies that have issued mandates have suggested workers who don’t comply could find themselves holding a pink slip.

For example, Amazon.com Inc. chief executive Andy Jassy late last year told employees that “it’s probably not going to work out” for them at the company unless they come in “at least three days a week.”

International Business Machines Corp. also recently said any manager still working from home would need to move near an office or find themselves out of a job.

But employees have pushed back at being asked to come into the office more often. For example, workers at Amazon have held protests and circulated a petition demanding the company reconsider its RTO push.

Elon Musk’s X Corp., formerly known as Twitter, reportedly experienced a wave of resignations after he banned working from home.

Surveys repeatedly show that people value flexibility over other considerations such as salary or benefits.

Nearly two-thirds of Canadians said they’d even take a pay cut to keep their flexible hours, according to recent research from the Harris Poll and Express Employment Professionals.

And 38 per cent of professionals said they’d refrain from looking for a new role at another company because their current job offered flexibility, according to research by recruiter Robert Half Inc.

In good news for workers, evidence suggests 2024 could bring a lull in the RTO wars. Only four per cent of chief executives in both the United States and globally say they’ll push to get workers back to their desks this year, according to a January outlook from The Conference Board Inc.

They say a big reason they’re abandoning the fight is because

flexibility makes workers happy

and executives have made retaining and attracting talent their No. 1 priority this year.

At a time when many executives are focused on reining in costs amid a slowing economy,

keeping the employees they have makes financial sense.

Productivity losses,

recruitment,

hiring

and training

can cost a company between six to nine months of salary,

according to Martin Fox, managing director of recruitment firm Robert Walters Canada Inc.

“A lot of people forget about the cost of losing talent,” he said.

“Companies have strong reasons to hold on to their talent.”

Scaling back RTO mandates could be one tool executives can leverage to keep employees satisfied, the paper by Katz suggests.

Plus, managers who doggedly push staffers to make the commute may be unwittingly signalling that the company is having some serious issues, which might give people more reason to quit.

That might mean any executive doubling down on their RTO mandate could be making a misstep.

“My interpretation is that RTO mandates are often a response to poor recent company performance, perhaps adopted by under-pressure CEOs,” Nicholas Bloom, a Stanford University economist and remote-work researcher, said on LinkedIn in response to the paper.

“These RTO mandates upset employees, but do not appear to yield performance benefits in return.”

No comments:

Post a Comment